Blog

Blog

The gathering storm: An opportunity to reorder the healthcare industry

Leaders will redesign their organizations for speed, accelerate productivity improvements, reshape their portfolio and innovate new business models, and reallocate constrained resources.

The once-in-a-century pandemic thrust the healthcare industry into the teeth of the storm. The combination of accelerating affordability challenges, access issues exacerbated by clinical staff shortages and COVID-19, and limited population-wide progress on outcomes is ominous. This gathering storm has the potential to reorder the healthcare industry and put nearly half of the profit pools at risk. Those who thrive will tap into the $1 trillion of known improvement opportunities by redesigning their organizations for speed, accelerating productivity improvements, reshaping their portfolio, innovating new business models to refashion care, and reallocating constrained resources. The healthcare industry has lagged behind other industries in applying these practices; players that are able to do so in this crisis could set themselves up for success in the coming years.

Fate whispers to the warrior, ‘You cannot withstand the storm.’ The warrior whispers back, ‘I am the storm.’Source unknown

Reorder or be reordered. That is the rallying cry for industry leaders.

The healthcare industry faces an acceleration in costs of nearly $600 billion in 2027, which could make healthcare less affordable and threaten the sustainability of industry margins. However, a path to weather the storm exists—the staggering $1 trillion opportunity to create value and improve healthcare by transforming the delivery of care, improving clinical productivity, applying technology, and simplifying administrative procedures.1 What’s more, this level of opportunity is based on innovations already in use and available to executives today. The imperative for companies that seek to thrive in coming years will be scaling up these innovations much more quickly than they currently do.

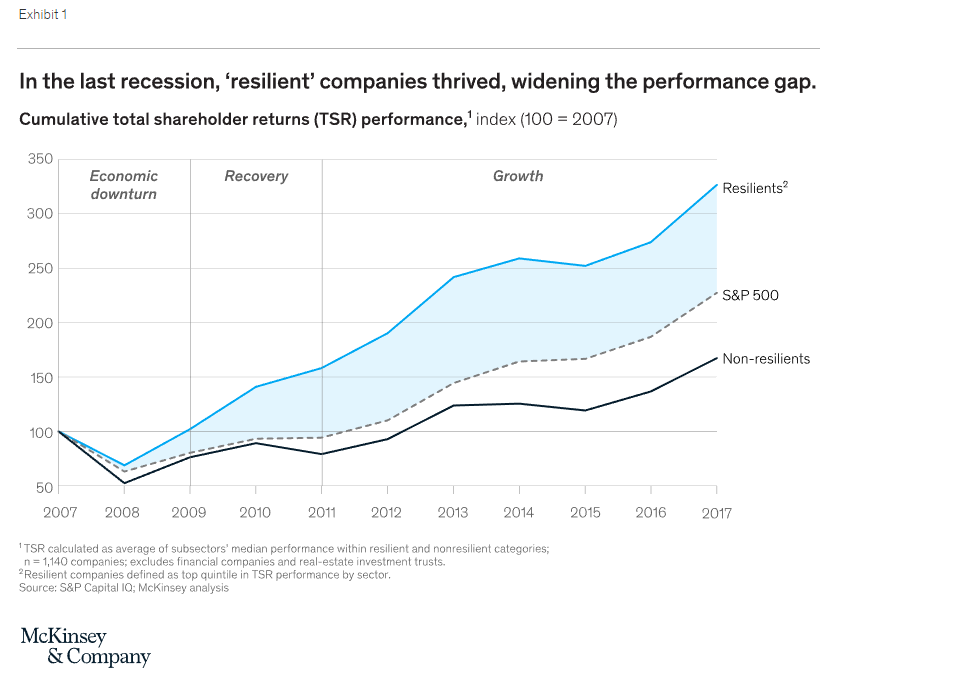

Our research from the last recession (2007–09) shows that challenging times for an industry can create a significant separation between resilient companies and others, meaningfully reordering the sector (Exhibit 1). The “resilients”—the top-quintile performers in each sector—did better at the outset of the downturn and widened the performance gap in subsequent years, delivering a cumulative total-return-to-shareholders lead of more than 150 percentage points, compared with the non-resilients, by 2017.2 For non-resilients, this lead was tough to reverse: nearly 70 percent of resilients remained top-quintile performers at the end of the decade, with few non-resilients joining them.3

The coming years will provide a test for leaders of incumbents and disruptors across the healthcare industry. If history serves as a guide, companies that rise to the occasion will probably be rewarded with sustained overperformance, creating strategic distance from their competitors and establishing themselves as recognized leaders in improving healthcare. In the healthcare sector, resilients are likely to be organizations that deploy four actions faster and more effectively than their peers.

Action 1: Redesign for speed

The pandemic forced executives in all sectors to make extensive changes to increase the flexibility and speed of decision making in their organizations. Nowhere were these changes more critical than in healthcare, which served as the nation’s front line of defense against COVID-19. As society transitions toward managing COVID-19 as an endemic disease, healthcare leaders might take this opportunity to identify which changes from the past two years are working and which have outlived their usefulness. Of particular importance is for leaders to be even more bold to sustain the gains made during the pandemic and further increase the speed of decision making and execution.

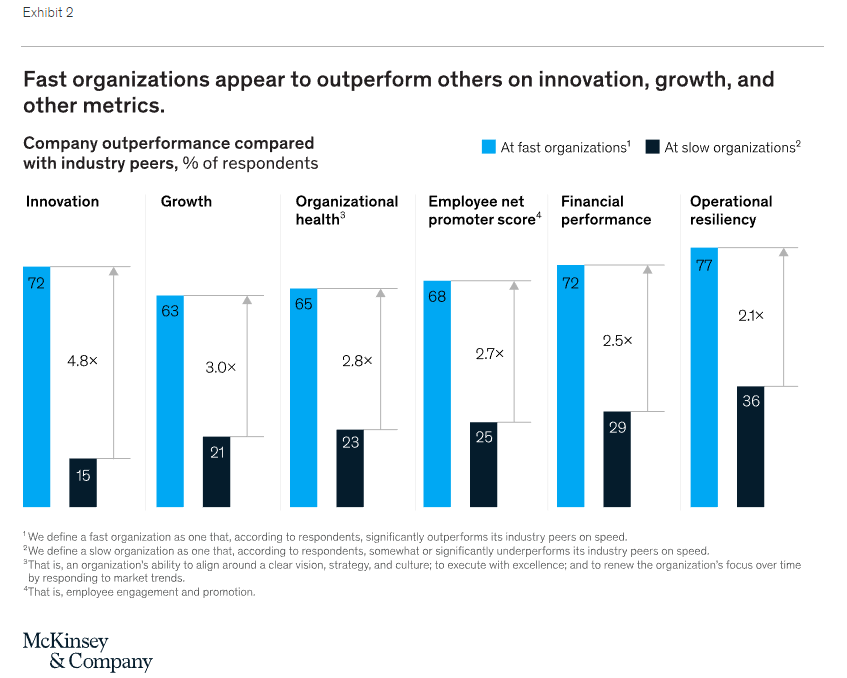

Our research shows that a concerted effort to become faster pays off (Exhibit 2). Fast organizations outperform others by a wide margin on a range of outcomes, including profitability, operational resilience, organizational health, and growth.4 Often, these advantages are even more significant in difficult times, when decisions have more important consequences, and it is necessary to outpace competitors at every phase of the process. That kind of speed will be essential during the next few years. The devastating effects of cost increases eroding affordability and margins require scaling-up speeds (for example, executing a six-fold increase in the number of patients in risk-bearing, value-based care arrangements in the next five years) unlike those the industry has ever attempted.

But increasing an organization’s speed isn’t easy. Even most executives at sector-leading operators can identify at least a few hurdles that prevent them from moving even faster. Organizational silos, unclear strategies, and slow processes frequently interfere with attempts to make decisions and get work done more quickly. To increase speed and improve resilience, leaders could start by asking these questions:

Identify the bottlenecks. What are the top one to three bottlenecks slowing down the organization? What has prevented the organization from addressing them, and what can you do to remove them now?

Enhance the operating model. Are roles and responsibilities for key processes identified clearly? Have unnecessary stage gates that stymie decision making been removed?

Actively monitor potential risks. Have trigger points been set to enable immediate action when thresholds for key decisions are crossed?

Action 2: Double down on productivity

Increasing efficiency is a perennial objective of healthcare executives, but for most organizations, incremental improvements probably cannot meet the moment. To survive the coming storm, leaders must shift their mindset and adopt much bolder aspirations to raise productivity. Of course, bold actions must be thoughtfully prioritized to improve not only the costs but also the quality of care, access, and the patients’ experience.

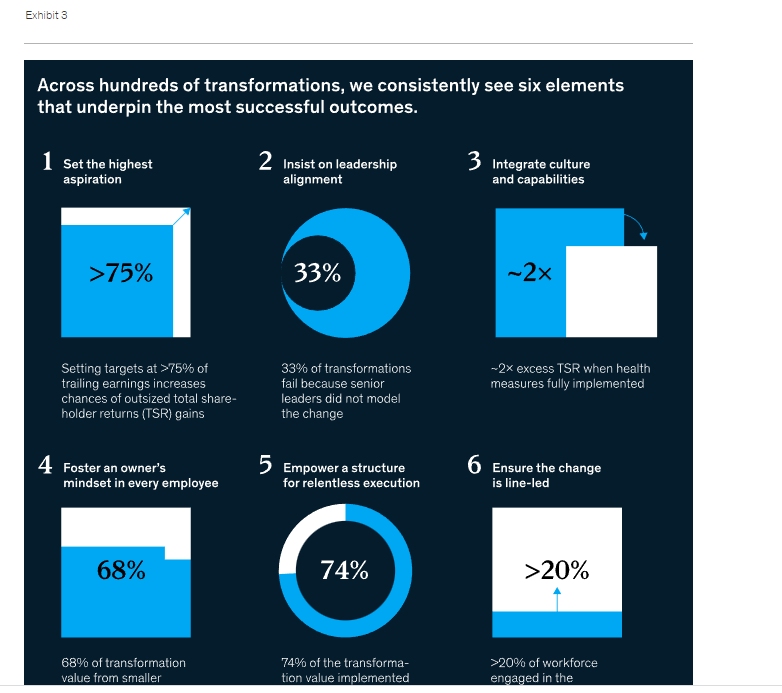

Our research shows that challenging times can create opportunities for step changes in productivity and that, as we have noted, companies making faster and bolder moves during downturns perform better over the long run (Exhibit 3). In the last recession, the resilients heeded the warning signs earlier, cutting operating costs as a percentage of revenue by an average of 50 basis points at the start of the downturn and by 350 basis points through the recovery. These moves gave resilients a substantial head start over the non-resilients, where costs rose during the downturn and fell only slightly in the recovery.5

Simply put, transformations are vital in this environment.

Providers

The need for improvement is particularly urgent for providers, many of which face a one- to two-year lag between the elevated costs they incur today and the opportunity to negotiate higher reimbursement rates from payers. On top of this, providers are experiencing poor year-to-date performance and a souring outlook for investment income, which has served as a significant buoy for health system finances over the past decade.

To manage through this difficult period, providers have an opportunity to reimagine how things get done in back-office functions and the delivery of clinical care and to prioritize the most critical work. Providers can pursue transformations that address a comprehensive set of value levers, including clinical operations, external spending, and general and administrative expenses.

They might also use current labor shortages and increased competition for talent as an opportunity to reduce the amount of labor needed to get work done: for example, to help teams work at top of license, providers could roll out innovative technologies (including automation) and use tried-and-true playbooks for staffing, scheduling, and redesigning models of care. Successful initiatives could improve not only financial performance but also the patient and caregiver experience, while increasing access and quality.

Payers

To avoid unsustainable price increases for purchasers, payers too will need to accelerate their efforts to cut medical and administrative costs. In particular, payers could play a leadership role in transforming the delivery of care—for example, by significantly increasing the number of value-based care programs, enabling and scaling up new care models in lower-acuity and more convenient sites of care (including homes and virtual care), and reimagining care pathways to make them more effective and efficient.

At the same time, payers should also improve their productivity—for example, by redesigning internal processes, deploying new technology (including automation), and focusing on performance management. Beyond their own four walls, payers should seek ways to help reduce the 25 percent of national health expenditures spent on administrative expenses. Known interventions could lower the level to 18 percent, a goal that payers are well placed to pursue in their role as orchestrators of the healthcare system.

Most institutions have undertaken performance improvement journeys, but few successfully assemble all the elements needed to ensure lasting change. In fact, our research finds that 70 percent of performance transformations fail. However, the odds of success increase dramatically—raising the success rate to nearly 80 percent—when organizations apply a proven playbook.6

Action 3: Adopt a growth mindset

In downturns, resilient companies seize the opportunity to distance themselves from competitors through investments in strategic growth.7 This strategy is doubly necessary in healthcare, where profit pools are rapidly shifting—in many cases, away from the core segments of the sector’s incumbents.

Unfortunately for those incumbents, the competition for attractive profit pools is fierce. Increasingly well-capitalized disruptors, for example, are rapidly deploying new business models to capture the fastest-growing and highest-margin segments. These disruptors are often unburdened by legacy constraints, bureaucracy, or the need to manage a separate core business. Some are backed by substantial venture-capital and private-equity funding. As a result, disruptors often get to market faster than incumbents accustomed to incrementally evolving business models.

But incumbents do not have to cede these opportunities. Although disruptors may have speed, incumbents may have their own natural advantages. These include existing relationships and the trust of patients and members, the ability to quickly scale up what works across markets, time-honed operational discipline at scale, and, in some cases, opportunities for diversified growth to strengthen the core business as well.8

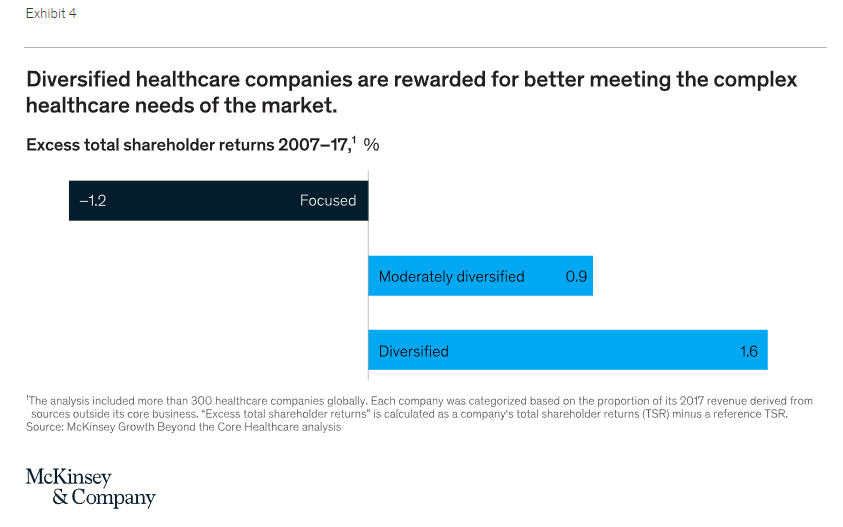

Several incumbents have already begun to see success through diversification. Large payers, for instance, have created diversified business units operating in care delivery, data and analytics, pharmacy services, care and utilization management, and other technology and service businesses. Some providers have created very profitable units to manage revenue cycles and enable value-based care. Our analysis has shown that diversified healthcare companies can deliver higher returns. Although this analysis is based on the returns of publicly traded companies, in our experience private not-for-profit healthcare organizations also often see financial benefits from diversification (Exhibit 4).

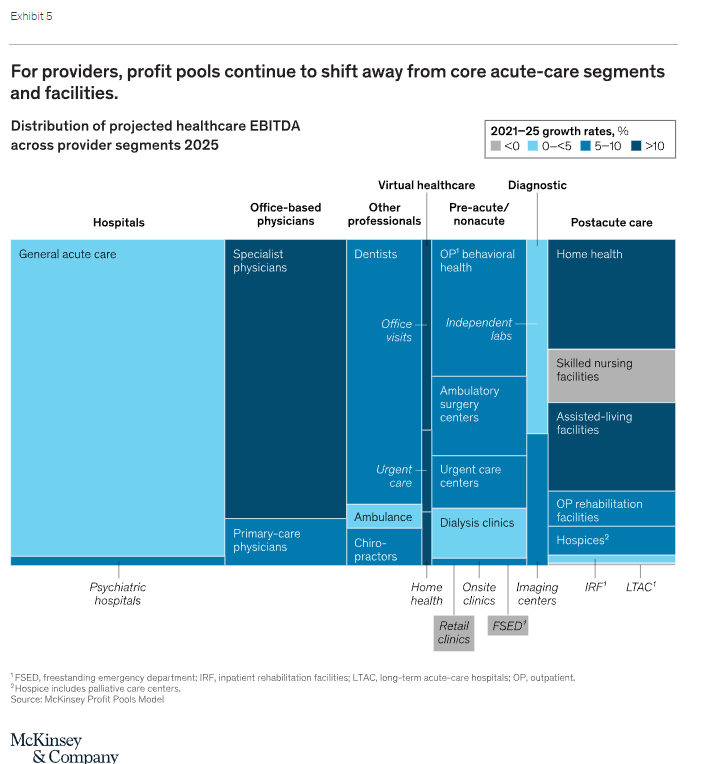

Where exactly might the sector’s leaders look for growth? For providers, profit pools are continuing to shift away from core acute-care segments and facilities9 and toward higher-value, lower-cost ambulatory, virtual, and home sites for care. These changes are driven by the preferences of patients and physicians and by sectoral shifts, including the increased adoption of value-based care models. Many health systems are already far along in developing a robust ambulatory footprint. Still, in these spaces it will probably be important to focus on buying, building, or partnering with innovators—for example, primary-care disruptors, risk-bearing management service organizations (MSOs), and virtual-care companies (Exhibit 5).

Payers face a similar imperative to diversify and reinvent their business models. Profit pools are shifting away from individual, small-group, and administrative-services-only insurance plans and toward government segments: the Medicaid, Medicare Advantage, and Medicare supplements segments are forecast to grow at a CAGR of more than 10 percent through 2025.

Moreover, the most successful managed-care models increasingly center on value-based–care arrangements with meaningful risk, the orchestration (and sometimes ownership) of nonacute care (for example, through risk-bearing MSOs), the integration of pharmacy services, and member engagement across the care journey. These models are improving costs, the quality of care, and the experience of members while expanding the total profit pool for payers. Our research has found that payers investing in such next-generation managed-care models achieve higher financial returns than their peers by delivering better value to the healthcare system.10

To succeed in achieving diversified growth, organizations need a set of competencies that may be new—and different from those required in the day-to-day business. These new competencies include programmatic M&A, partnerships, effective integration, and rapid business building.

Programmatic M&A and partnerships. Two decades of McKinsey research across sectors shows that programmatic M&A is more likely than large deals to deliver excess TSR at lower levels of risk.11 In healthcare, most innovative companies are small or midsize, and programmatic M&A is often the optimal approach for diversifying efficiently or for acquiring the capabilities needed to reinvent business models. Many of these assets are in high demand and command high multiples that may place them out of reach for all but the largest players. But even when an acquisition isn’t feasible, a range of partnership models could be structured to achieve as much value as M&A. These models typically require at least as much attention to derive value and must avoid a range of common pitfalls that derail negotiations and the long-term capture of value.12

Effective integration. Although the transformation playbook is essential to unlock value in the ordinary course of business, it is particularly salient during M&A integrations, to ensure that the anticipated value of the deal thesis is realized.13 Further, programmatic acquirers need to develop an integration competency that is “always on” and makes it possible to scale up and integrate an acquired company’s core operations quickly.

Rapid business building. Across sectors, business building is a top priority for growth, and healthcare is no exception.14 Developing a strong business-building capability may prove essential if attractive acquisition targets or potential partners do not exist or are not economical and the skills and experiences required to rapidly scale a new enterprise are quite different from the typical capabilities of healthcare incumbents. Business building is also essential when large incumbents buy innovative small to midsize companies but need to enlarge them many times over to handle the scale of the incumbents’ volume. However, the skills and experience required to scale a new enterprise rapidly are quite different from those typical of healthcare incumbents

Action 4: Reallocate constrained resources

Our research shows that across economic contexts, companies that actively reallocate resources outperform those that don’t.15 In challenging times, such a reallocation is more important than ever. Many organizations struggle to reallocate at the necessary pace. Successful reallocators follow a tested portfolio of processes that aim to seed high-growth areas with the resources necessary to succeed, while avoiding retrenchment in the core business.

Maintain absolute clarity on the objectives for capital allocation. The most successful reallocators take a clean-sheet, not incremental, approach to allocating strategic (as opposed to maintenance) capital. They focus on identifying the minimum allocation of maintenance capital to sustain the core business.

Take a dynamic approach to budgeting. To act quickly when markets shift or new opportunities arise, organizations should see budgets as rolling, not fixed. Remove budget anchors to avoid rubber-stamping the same allocations every year. And have clear ground rules for early termination to stop underperforming projects.

Align talent to value. Ensure that the best talent focuses on the most important growth areas.

To sum up, four sets of actions will help the healthcare sector weather the storm and outperform through the recovery. First, assess the speed of your organization to ensure that you can make hard decisions faster than your peers do. Second, launch (or recommit your organization to) a bold performance transformation that protects the core business, create business optionality on the balance sheet, and prepare to reinvest in growth.

Third, do invest in growth proactively through programmatic M&A and partnerships, effective integrations, and rapid business building. Put a particular focus on diversification and innovative business models aligned with the $1 trillion opportunity. Finally, reallocate organizational resources to realize the value creation agenda—for example, by taking a clean-sheet approach to capital and budget allocations.

The opportunities are known and the approaches we describe are proven. The imperative is strong leadership. Healthcare leaders must set clear priorities, adopt proven approaches for the necessary transformation, use M&A, build new businesses, and inspire action.

Πηγή: mckinsey.com