Blog

Blog

Pfizer, GSK prep for battle as they look to carve out share in the world’s first-ever RSV vaccine market

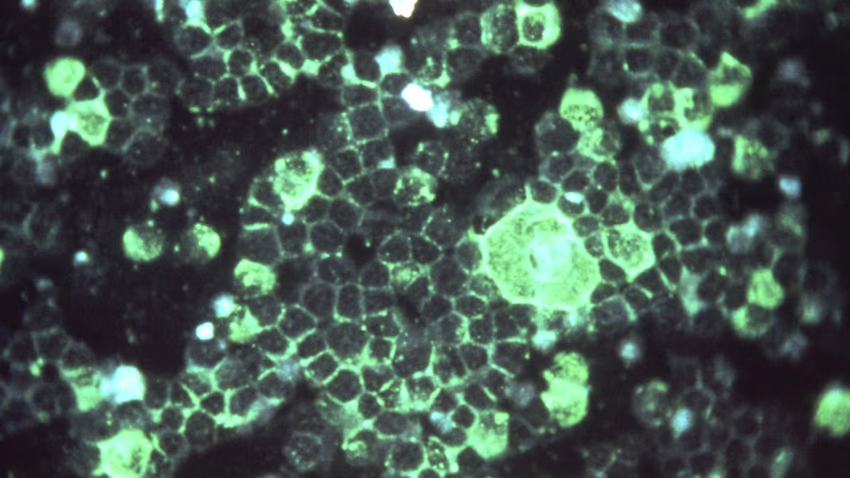

The Centers for Disease Control and Prevention (CDC) estimates that there are up to 120,000 hospitalizations among adults 65 years and older with RSV in the U.S. each year and up to 10,000 of them die. Among children under 5, the CDC says that there are around 58,000 annual hospitalizations and 100 to 300 deaths.(Dr. Craig Lyerla/Centers for Disease Control and Prevention)

Pfizer and GSK are already prepping for battle as the pair race into the new respiratory syncytial virus (RSV) market.

This week, both companies moved closer to regulatory approvals, and they could each see the first-ever approvals for an RSV vaccine in 2023. GSK nabbed a priority review and a May 3 approval action date for its RSV vaccine in older adults. Pfizer isn’t far behind, with an early stop for the trial of its vaccine given to pregnant women to protect infants and eyeing an approval filing by year-end.

With third-quarter earnings calls done this week, both companies’ CEOs spoke about their plans, and we got a feel for how they are seeing the new market. GSK’s chief executive Emma Walmsley said on a call with journalists that the company “intends to be competitive” with its late-stage shot, while Pfizer’s chief scientific officer Mikael Dolsten, M.D., Ph.D., told Barron’s that “efficacy [between Pfizer and GSK’s shots] look somewhat similar,” but “if you look at our tolerability, [it] was among the best vaccines you ever can see.”

“Obviously, it’s a competitive situation,” explained Walmsley on the call in response to a journalist’s question about its rivalry with Pfizer, as both look to have their RSV jabs approved next year. “I would say that I don’t think that’s a bad thing at all, especially when we have the very high confidence we do in the profile of our vaccine. It’s not a bad thing at all in a new market to have more than one competitor.”

GSK had hoped to develop a vaccine for both infants and those 60 years and older, but a safety concern in its maternal vaccine trial scuppered the plans for the former. Walmsley said in the call, however, that “in older adults, [RSV infection] is much more significant to hospitalization than it is for babies,” and therefore that market will be bigger for any company.

Pfizer said this week that it expects to go to the FDA with its RSV shot for older adults and in maternal use by year’s end. The vaccine’s phase 3 read out in infants came out just this week and was broadly positive, with the Pharma linking the administration of its bivalent RSV prefusion vaccine candidate RSVpreF, also known as PF-06928316, during pregnancy to a significant reduction in the rate of severe medically attended lower respiratory tract illness (MA-LRTI) in newborns.

However, the study came up short against the second co-primary endpoint, which looked at the effect of RSVpreF on the rate of all severities of MA-LRTI.

The adult market, however, may be the bigger prize. The Centers for Disease Control and Prevention (CDC) estimates that there are up to 120,000 hospitalizations among adults 65 years and older with RSV in the U.S. each year, and up to 10,000 of them die. Among children under 5, the CDC says that there are around 58,000 annual hospitalizations and 100 to 300 deaths.

Pfizer’s CEO Albert Bourla, Ph.D., was bullish on his company’s RSV hopeful. “I think we will be the leaders in this market,” he told Barron’s, given that his is the only company to gun for an RSV vaccine with both maternal and older adults usage.

Bourla did, however, in the interview reject the idea that the RSV vaccine market could be commoditized, with vaccines competing with each other on pricing. “I don’t think that in modern high-tech vaccines there is a price war or commoditized markets,” he said. “They are priced accordingly to their value, and then someone will get the big markets, or someone will get the small.”

While GSK has a long history of vaccine development and launches, Pfizer’s experience with its pneumonia shots and most recently with its BioNTech-partnered COVID vaccine Comirnaty will clearly also be of major help if it gets approval for its RSV shot. RSV is, however, a very different market. With COVID, the world was waiting on tenterhooks for a shot, but getting the right awareness and education about RSV vaccines will be a more complex campaign for both companies.

The other major COVID vaccine player in the U.S., Moderna, is also looking to get into the RSV vaccine market but is further back compared to Pfizer and GSK. Moderna entered phase 3 testing this year for its mRNA candidate.

AstraZeneca and Sanofi, meanwhile, are developing a long-acting antibody designed for all infants for protection against RSV disease from birth through their first RSV season with a single dose. Monoclonal antibodies do not work as vaccines, as they do not require the activation of the immune system to help offer timely, rapid and direct protection against the disease. AstraZeneca and Sanofi expect FDA submission acceptance in Q4 2022. This will be the main competitor for Pfizer, should the vaccine nab U.S. approval.

Πηγή: fiercepharma.com