Blog

Blog

Strategic Realignment for a Better Future

Ben van der Schaaf and Aurelien Guichard discuss how the industry will be forced to overcome its hesitation to innovate in operations.

Amid the search for effective COVID-19 treatments and vaccines, the pandemic will have long-term side effects for the global pharmaceutical industry. As our article explains, companies will need to focus on change in three areas (portfolio reprioritization, accelerated R&D and technology transformation) if they are to position themselves successfully for the future.

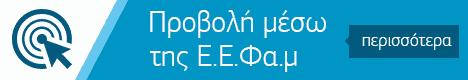

The life sciences sector faces significant impact from COVID-19 — and although the race for treatments and vaccines is dominating the headlines, the effect on the industry will not solely be positive. In the short term, some companies are laying people off and reducing operations, whereas others are reallocating resources to focus on COVID-19, or even ramping up efforts in other areas. Stock-market performance has been as diverse (Figure 1).

Organizations need to consider major strategic questions now, to ensure their success in the longer term. The industry is clearly in the middle of the efforts to combat COVID-19:

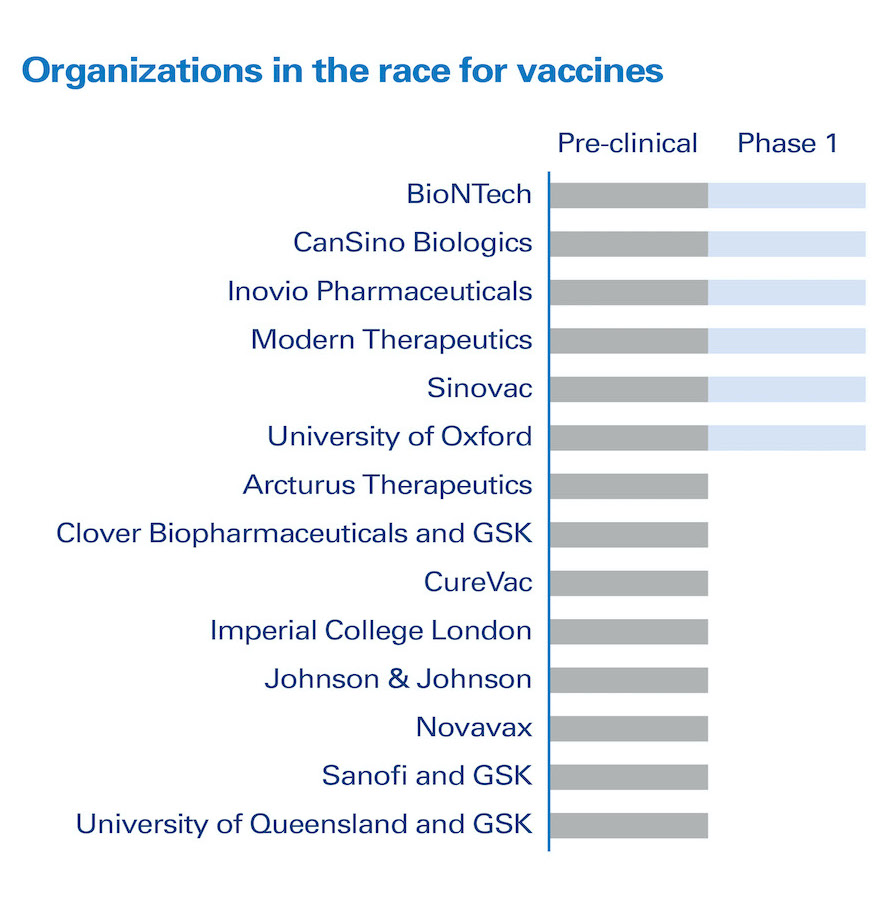

• More than 20 companies are trying to find a treatment with either new or approved drugs.[1]

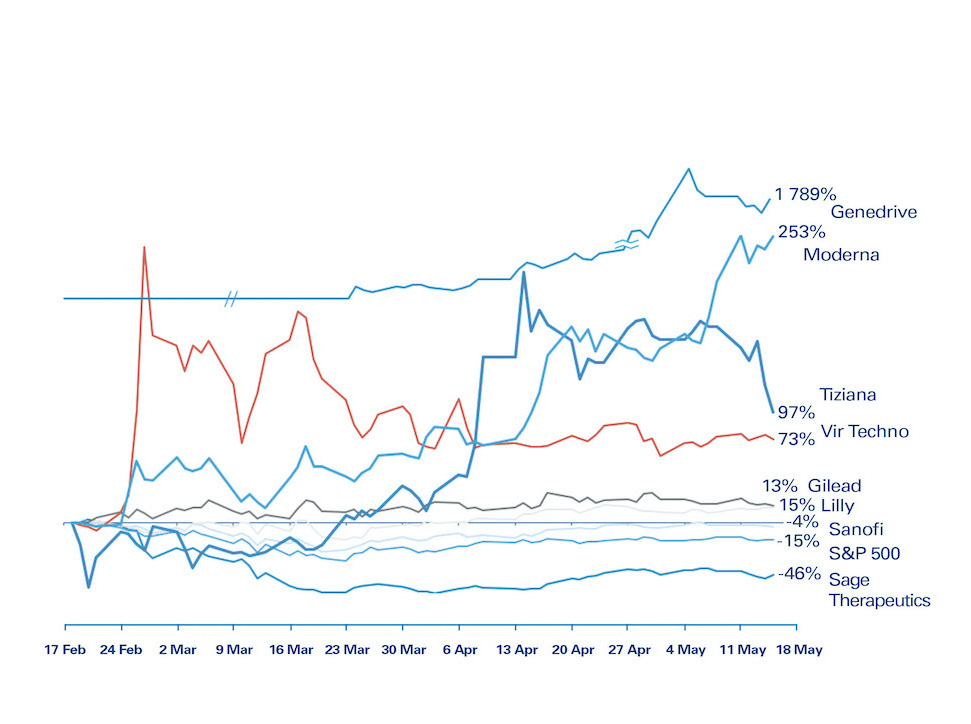

• More than 15 companies globally are mobilizing resources to develop new vaccines.[2]

• Globally, by the end of May, more than 1,300 clinical trials related to COVID-19 were recruiting patients.[3]

This work is driving collaboration between pharma companies, research institutions and government agencies, and does not even include ongoing projects in the diagnostics industry.

In this article we look at the impact of the crisis on life sciences and the long-term prognosis, and suggest some priorities for executives to consider in order to position their companies best.

The impact of COVID-19 on life sciences

Our assessment is that the industry will see significant change in at least three areas:

1. Strategy – realigning the portfolio: Companies that are allocating significant resources to COVID-19 are forced to re-prioritize their limited resources, reducing their focus on other activities.

2. Acceleration of R&D: The urgency to identify treatments (from either new or approved medicines) and vaccines has caused health authorities to turn things around with unparalleled speed. This will raise expectations for shorter timelines in the future. For example, the US government is working on an accelerated vaccine program under the name “Warp speed.”[4]

3. Rapid adoption of technology and transforming operations: This involves digital innovation, especially to solve the dilemma of the pharma “innovation paradox”, whereby highly innovative companies in R&D are quite conservative in operational innovation.

1. Strategy – Realigning the portfolio

Refocusing significant efforts on COVID-19 will not be without consequences. A dollar can be spent only once, and even though people and systems can be more productive, this will inevitably lead to de-prioritization of R&D activity in other areas.

• A significant number of companies are allocating substantial resources to either developing or identifying treatments or developing vaccines for COVID-19 (Figures 2 and 3). This will require reallocating resources (people, facilities, budgets), which will lead to other programs being delayed or cancelled. As it is difficult to cancel an ongoing clinical trial, this will mostly impact programs that have not yet started. This means for some patients it will take longer for treatments to become available, or it may not ever happen. Clinical programs have expiration dates linked to patents, and must be executed by certain times to be attractive commercially.

• M&A opportunities: Although the industry is generally cash rich, there are plenty of early-stage companies that will find it hard to survive this crisis, and others that are currently vulnerable due to other factors. This may mean good acquisition opportunities for private equity, venture capital and larger pharma companies.

2. Acceleration of R&D

The pandemic is forcing companies, regulators and governments to enhance collaboration and speed up R&D activity in multiple ways. Regulators have demonstrated that they can act fast if they need to, and this potentially sets new standards for the future.

• The urgent drive for treatments and vaccines is forcing companies to do things in ways they haven’t done before at this scale (although the Ebola and H1N1 scenarios hold learnings that are being leveraged) and compelling regulators to (re)act much faster than they are used to. Clearly these are extraordinary circumstances, and some of this progress will fall away when the situation normalizes. However, some of the lessons that companies and regulators are learning should stick, which will result in a smoother and faster process. Certain caveats remain – a clinical trial that takes two years to perform cannot feasibly be delivered in less time. The randomized clinical trial will remain pre-eminent.

3. Rapid adoption of technology and transforming operations

The pharmaceutical industry is home to an interesting paradox. It has a well-deserved reputation for innovation, based on its R&D output and scientific prowess. However, when you shift from science to operations there is generally resistance to innovation and doing things differently. This means that while organizations have been looking at options for telehealth, virtual trials, wearables, etc., progress has been cautious and slow.

From an operational perspective, most of the pharma industry has rapidly adopted working from home, opening quite a few eyes along the way. Remotely selling medicines or conducting clinical trials is a lot harder, but significant efforts are being made to adapt operations. Research labs and manufacturing facilities need to maintain core operations on site, but the overall impact has been enough for pharma executives to start making plans for (radically) new ways of working:

• Pharma has been reluctant to adopt digital beyond iPads for sales reps and other logical applications. COVID-19 has radically changed this attitude, with future concepts now up and running. With pharma associates not allowed into hospitals to monitor clinical trials, sales reps not welcome at doctors’ offices, and patients unwilling or unable to go to trial sites to get their medications or undergo their assessments, companies have had to be agile to maintain the integrity of trials and protect their major investments. This has opened the door to home visits (a key component of virtual trials) and implementation of telemedicine, which are expected to be here to stay.

• The same applies to working arrangements, with companies concluding that they can safely rethink these quite radically.

These are just two areas, and beyond innovation and operations, it may have a dramatic impact on culture. Taking risks in operations, rather than just in major development programs, will become acceptable. Companies will therefore need to develop new capabilities to manage these.

Long-term prognosis for the industry

Everyone now uses the already-cliché phrase “the new normal.” Pharma executives, who are used to thinking long term while, at the same time, providing shorter-term updates to Wall Street analysts, are looking well beyond the crisis and planning how to best position their companies to take advantage of the changed world.

Currently, it appears the life sciences sector is not going to be hit very hard financially. Although there is significant longer-term uncertainty, compared to other sectors pharma is positioned to come out well. There will be strategic opportunities for new operating models, increased productivity from new and accelerated technology, and potentially more efficient ways to market as regulators change how they operate.

However, the overall environment will change significantly and impact how well pharma companies can recover and grow:

• The general economy: Over 40 million people lost their jobs in the US due to the coronavirus outbreak by late May 2020,[5] and a study by the Kaiser Family Foundation estimates that more than 27 million Americans may lose health insurance, with almost 6 million of those not eligible for any subsidized coverage.[6] In Europe and Asia the impact will be different and slower, but governments everywhere have gone very deep into the red, which has led to increasing pressures on budgets. Healthcare costs are an obvious target, which means drug prices will be under close scrutiny. This will impact the top line, and executives have to look at how to maintain margins, including new opportunities uncovered during the crisis. Hospitals have been hard hit financially, which will impact their spending and ability to support clinical trials going forward.

• Operational transformation: Having been forced into wholesale adoption of technology much faster than anticipated or desired, life sciences companies will come out of the crisis with a new set of capabilities and a thirst for putting them to work. Telemedicine, artificial intelligence and machine learning, data science, and a range of digital tools are now being used in clinical trials, sales activities and other areas. The drive to implement and innovate outside R&D has become stronger. Full transformation will not happen overnight, but the industry will not return to pre-crisis operating methods.

• Coronaviruses are here for the long term: Most experts expect that the current coronavirus, and potential new ones, will not depart soon. This means the pharma industry has a role to play in the long term, and a commercial model is needed. This needs to fit with public expectations to avoid impacting the industry’s reputation. For example, in early May, the pricing of Remdesivir by Gilead (the first therapy approved for COVID-19) was a hot topic. Of all the companies engaged in COVID-19-related trials, most will just come out of it with experience and goodwill. A few will be successful, and given the size of the market for both therapy and vaccines, blockbuster status seems assured. The global vaccine market has already been growing at a healthy rate (Figure 4), which is now likely to improve. Scaling fast and globally will be a challenge, but is a core competency of big pharma. Who “wins” could impact the whole industry – as shown by the share price of Moderna quadrupling in less than three months on high hopes for vaccine development.

Insight for the executive

The crisis is an opportunity for the pharmaceutical industry to do what it excels at – developing innovative therapies and vaccines by using its scientific and operational capabilities, and as a side benefit, enabling the sector to reshape its public image into something much more positive. In our view, the life sciences sector will come out of this crisis stronger, but this won’t happen automatically. There are some takeaways for executives as they position themselves for the new normal:

• Consider current strategies relative to the new environment. What is changing in the therapeutic areas in which you are active, and do you need to adapt? Are there any assets out there that are complementary to your portfolios and can be acquired for good prices? Is the risk landscape changing?

• If the R&D timeline is shortened, what does that mean for you specifically? Where in your organization do you need to change and bolster capabilities so you can take maximum advantage of a shifting landscape and time lines? If you make those choices now, you will have a head start when the “new normal” becomes actually normal.

• Pharma needs to step up the development of data science and digital capabilities. Companies understand this, and although some have made progress, it needs to become ubiquitous. This will push pharma over the hump and turn it into the data industry it really wants to be.

Lastly, if you are not in the coronavirus rat race of developing COVID-19 therapies or vaccines, build an understanding of the areas de-prioritized by others, and execute your strategy to take advantage. Patients need it.

A view of global vaccine revenue ($BN) with 2019 and 2020 projected. The COVID-19 vaccine, once available, will change this picture

Ben van der Schaaf is Partner and Aurelien Guichard is Manager and US Lead for Energy & Utilities, both at Arthur D. Little.

[1] Marketwatch.com, 6 May 2020.

[2] Drugtargetreview.com, 9 April 2020.

[3] clintrials.gov, 31 May 2020.

[4] sciencemag.org, 12 May 2020.

[5] New York Times, 28 May 2020.

[6] Kaiser Family Foundation, 13 May 2020.